Basic Philosophy for Corporate Governance

Our basic philosophy for corporate governance is based on our mission: “We contribute to the health of society through our diligent efforts to create healthcare solutions that have a positive impact and improve the lives of people.” To put this philosophy into practice, we have built a governance system that enables management to efficiently confirm compliance with applicable laws and regulations and the Articles of Incorporation. Furthermore, we prioritize corporate governance from the perspective of ensuring management soundness, efficiency, transparency, and sustainably increasing corporate value.

Strengthening Corporate Governance

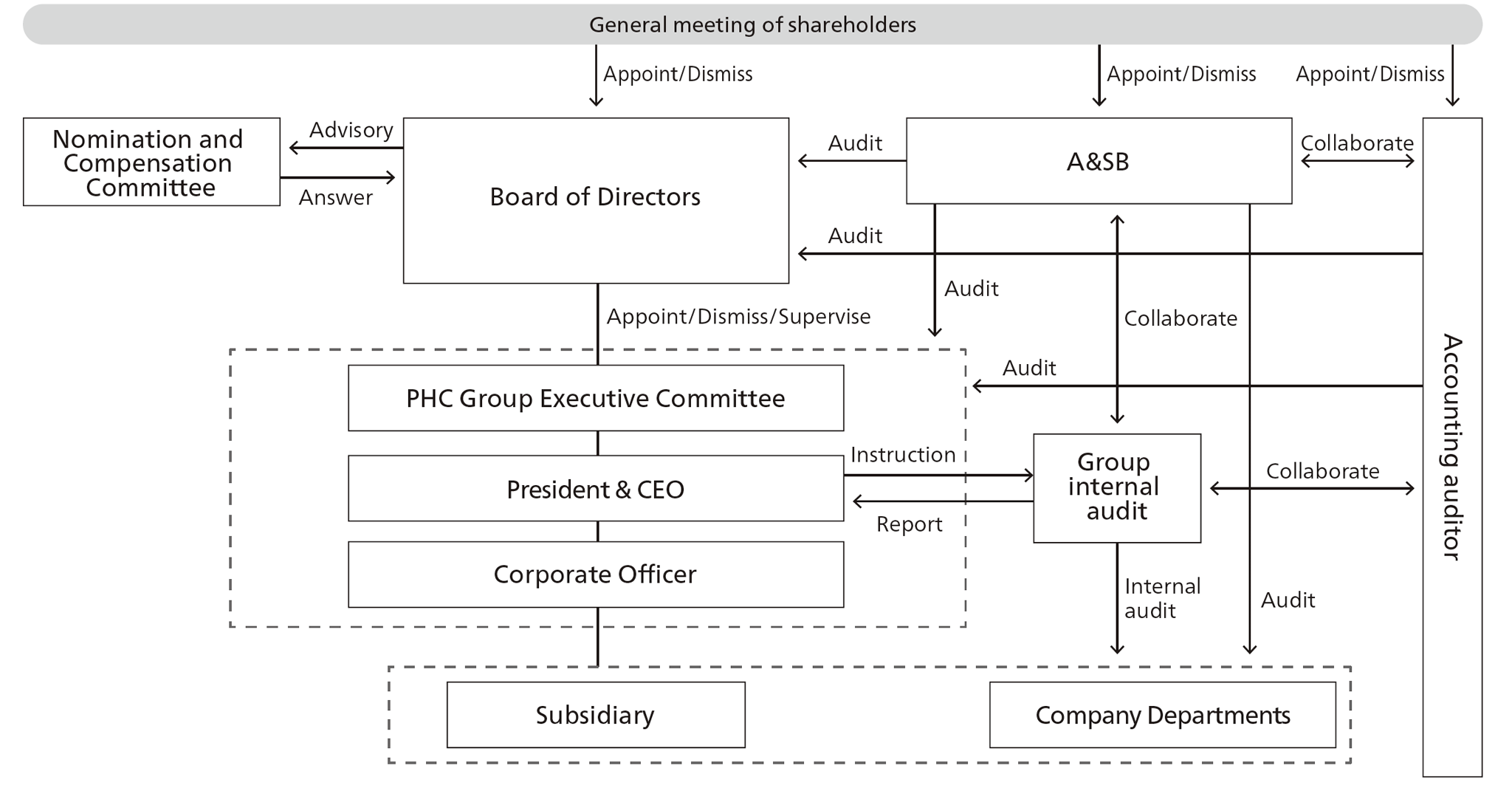

Strong corporate governance is essential to ensure transparency, fairness, and timeliness in management, and to achieve sustainable corporate growth and improvement in corporate value. One concept related to these goals is the establishment of a system for management execution and supervision. In order to increase the timeliness of corporate management decisions and activities, we have introduced an executive officer system with an Audit and Supervisory Board. This structure promotes accountability and creates two layers of auditing for legal compliance through supervision by the Board of Directors and the Audit and Supervisory Board.

We have strengthened our governance functions by separating the business supervisory and business execution functions in corporate management and by clearly defining the responsibilities of directors.

Regarding the supervisory system, PHC Group strives for effective supervisory functions and highly transparent management by appointing multiple independent external directors to the Board of Directors.

The majority of members on our Audit and Supervisory Board are external auditors, and we have established a highly independent auditing system for the execution of duties by directors. In this way, we have established a system to monitor and advise the overall effectiveness of the Board of Directors from an objective and neutral standpoint.

Also, in order to support the Board of Directors, PHC Group has established a voluntary Nomination and Compensation Committee, whose main members are independent external directors.

Board of Directors

The Board of Directors is composed of eight directors, including six external directors. In addition to regular monthly meetings, the Board also holds extraordinary meetings as necessary. The Board makes decisions on important business matters related to overall management, and supervises the execution of duties by directors. The Board shares the company’s management philosophy, vision, and values. Based on these principles, the Board discusses and decides on Mid-term Plans, single-year plans, and other important measures.

The Board of Directors also receives regular reports from management on the status of business activities and makes decisions on important business matters based on these reports.

PHC Group Governance Structure

Nomination and Compensation Committee

To support the Board of Directors, PHC Group has established a voluntary Nomination and Compensation Committee, whose main members are independent external directors. The Nomination and Compensation Committee deliberates and makes recommendations on matters related to the appointment and dismissal of directors, succession plans for representative directors and executive officers, and matters related to compensation of directors and executive officers to be submitted to the general meeting of shareholders.

Regarding the position of Representative Director and President (CEO), the Nomination and Compensation Committee is responsible for selecting a person who demonstrates leadership in realizing our corporate mission and management philosophy and achieving sustainable growth of the company.

Activities of the Nomination and Compensation Committee

In fiscal 2023, the Committee held a total of seven meetings, and the attendance rate of Committee members at each meeting was 100%. The main topics of deliberations and reports were as follows:

- Status of executive's 2022 individual evaluations, succession plans, and in-house training program review

- Setting of performance targets

- Evaluation of potential successors

- Performance indicators for a post-delivery performance-based stock compensation plan and interim evaluation of directors and officers

- Progress of executive appointment, executive compensation, and in-house training programs

- Nomination of candidates for new independent external director

- Granting of retirement benefits to retiring directors and officers

Executive Committee

PHC Group has established an Executive Committee for the purpose of streamlining management-related decision making and clarifying decision-making procedures. Meetings of the committee are held monthly. The Executive Committee is an executive meeting body that decides on important matters related to the management of the Group (including all capital subordinate companies) and manages the objectives and progress of plans for the entire Group.

The current composition of the Executive Committee is as follows: Members: Kyoko Deguchi (Chairman), Koichiro Sato, Ryuichi Hirashima, Kaiju Yamaguchi, and Koichi Ikeuchi (Observer).

Appointment of Officers

The Articles of Incorporation stipulate that resolutions for the appointment of officers shall be made by a majority of votes at a general meeting of shareholders attended by at least one-third of the shareholders who are eligible to exercise their voting rights. Moreover, the Articles of Incorporation stipulate that cumulative voting shall not be used for resolutions to elect officers.

When selecting external officers, our basic policy is to consider the skills and experience of full-time officers and executive officers, and then select individuals who have the skills and experience to supplement the company’s needs as external officers.

Criteria and Qualities for Evaluating the Independence of Independent External Directors

When appointing external directors and external auditors, the company determines its independence based on the independence standards set by the Tokyo Stock Exchange and the "Standards for Independence of Outside Directors" stated by the company based on specific figures or amounts. The company appoints individuals who are capable of making appropriate contributions to its management from an objective perspective based on their extensive knowledge and experience. When appointing external directors and external auditors, the Nomination and Compensation Committee shall deliberate on compatibility with independence standards and policies, and the results shall be escalated to the Board of Directors, which will deliberate upon those results and make a decision.

Officer Training Policy

The company provides various training opportunities not only for directors and members of the Audit and Supervisory Board, but also for all employees to acquire and appropriately update the knowledge necessary for their responsibilities and work. Training for officers is also based on the same policy.

When new external directors and members of the Audit and Supervisory Board are appointed, in addition to their legal roles and responsibilities, the company also provides information necessary for those officers to contribute to effective supervision of the company’s management from the perspective of transparency and fairness (for example, industry information, company history, business overview, financial information, strategy, organization, etc.).

In addition, for active deliberations of the Board of Directors, we provide opportunities to acquire and update the knowledge necessary for management supervision, and the Company bears the cost of seminars/networking events, etc., in which each officer voluntarily participates according to his or her needs.

Support System for External Directors (External Auditors)

For external directors and external auditors, the Legal and Compliance Department provides support such as advance explanations of proposals for meetings of the Board of Directors and information to enable sufficient discussion at those meetings. For external auditors, information and other support is provided by members of the Audit and Supervisory Board and by the Auditing Office, which is comprised of full-time staff and functions as the secretariat for the Audit and Supervisory Board.

Evaluation of the Effectiveness of the Board of Directors

In March 2024 the company conducted a questionnaire survey and individual interviews regarding the effectiveness of the Board of Directors as a whole among all directors (eight people) and members of the Audit and Supervisory Board (three people). The survey covered the following topics:

(1) Composition of the Board of Directors

(2) Matters related to the operation of the Board of Directors

(3) Effectiveness of the Board of Directors as a whole

(4) System related to support and cooperation with external directors

(5) Audit function

(6) Nomination and Compensation Committee

(7) Others (Status of responses to issues pointed out in the previous effectiveness evaluation, etc.)

In order to ensure objectivity, we received support from a third-party organization in setting the survey content and analyzing and assessing evaluation results. Based on the results of the analysis by the third-party organization, the Board of Directors assessed the current situation and issues.

1. Summary of evaluation results

We believe that the Board of Directors as a whole is functioning appropriately and effectively. In addition, with regard to "Expediting the timing of bringing important proposals to the Board of Directors and the distribution of documents for the meeting," which was identified as a major issue in the previous effectiveness evaluation, the deadline for submission of proposal materials has been tightened and improvement has been seen through efforts such as promoting the provisional submission of drafts. However, to further improve effectiveness, we recognize the following points as the main priorities going forward.

- Conducting periodic follow-up after implementation of investment projects

- Analyzing the achievement status of the mid-term plan, revising the plan, and utilizing it for the next plan

- Reports and discussions at board meetings regarding investments, etc.

- Monitoring ESG initiatives and discussing materiality topics of sustainability

2. Future measures

In addition to taking steps to advance the priorities identified above, we will continue to conduct effectiveness evaluations every year and continue efforts to improve the effectiveness of the Board of Directors as a whole.

Regarding Executive Compensation

1. Basic policy

- Compensation is appropriate, and is linked to the growth and improvement of performance by our Group.

- Compensation takes into account the link between company performance and individual performance.

- To stakeholders, the details can be explained and transparency is ensured.

2. Compensation structure

- Director compensation consists of monthly compensation, short-term performance-linked compensation, and retirement benefits.

- Compensation for external directors consists of monthly remuneration only, while the compensation of independent external directors consists of monthly remuneration and stock compensation.

- The compensation of external auditors consists only of monthly remuneration.

3. Basic compensation

This is a regular monthly compensation that is determined depending on roles and responsibilities, as based on the results of a survey by an external organization.

4. Short-term performance-linked compensation

- We provide short-term performance-based compensation as an incentive for achieving business performance goals.

- The evaluation indicators for short-term performance-linked compensation are “core sales” as an indicator for evaluating business growth potential, and “operating income” and “net income” as indicators for evaluating profitability.

5. Medium- to long-term performance-linked

compensation (stock compensation)

In fiscal year 2024, the Company introduced a stock compensation plan for independent external directors consisting of Restricted Stock Units (RSU) and a post-delivery performance-based stock compensation plan for internal directors consisting of Performance Stock Units (PSU). The purpose of these plans is to incentivize the directors to enhance sustainable corporate value and to promote further value-sharing between directors and shareholders.

6. Compensation governance

- The compensation structure, compensation composition ratio, base compensation level, and performance indicators and evaluation methods for performance-linked compensation are determined based on deliberations and reports from the voluntary Nomination and Compensation Committee.

- The amount of compensation for each director is determined by a resolution of the Board of Directors, based on the deliberations and reports of the voluntary Nomination and Compensation Committee, of which more than half are independent external directors.

* Please refer to the Annual Securities Report for the fiscal year ending March 2024 for the total amount of compensation, etc., for officers and consolidated remuneration, etc., for each officer (100 million yen or more) in fiscal 2023.

https://ssl4.eir-parts.net/doc/6523/announcement1/89942/00.pdf (in Japanese)

Compensation structure

| Officer classification |

Total amount of compensation, etc. (million yen) |

Total amount of compensation by type (million yen) |

Number of eligible officers (persons) |

| Fixed compensation |

Stock options*1 |

Performance-linked compensation*2 |

Retirement benefits |

Others |

Of the columns listed on the left, non-monetary compensation, etc. |

Directors

(excluding external directors) |

217 |

120 |

ー |

63 |

33 |

ー |

ー*3 |

2 |

Audit and Supervisory

Board Members

(excluding external auditors) |

23 |

21 |

ー |

ー |

1 |

ー |

ー |

1 |

| External directors |

68 |

58 |

10 |

ー |

ー |

ー |

10*4 |

3*5 |

| External auditors |

29 |

29 |

ー |

ー |

ー |

ー |

ー |

2 |

- The stated amount of stock options is the calculated price as of the end of March 2024.

- The targets and results of indicators related to performance-linked compensation for the current consolidated fiscal year are as follows. Each index was reviewed by the Nomination and Compensation Committee and approved by the Board of Directors, taking into consideration the balance and comprehensiveness of the company’s business growth potential, profitability, and efficiency.

The operating profit below is the adjusted operating profit excluding one-time expenses.

- The stated amount of stock options is the calculated price as of the end of March 2024, and is recorded as non-monetary compensation.

- The limit for stock option compensation for independent external directors will be 70 million yen or less per year (the number of independent external directors at the time of the resolution is three), as determined by a resolution at the ordinary general meeting of shareholders held on June 29, 2022. The stated amount of stock options is the calculated price as of the end of March 2024, and is recorded as non-monetary compensation.

- The number of external directors excludes the number of unpaid external directors.

- The maximum amount of compensation for directors is 1,500 million yen or less per year (the number of directors at the time of the resolution is 7), as per the resolution of the extraordinary general meeting of shareholders held on November 30, 2020.

- The maximum amount of compensation for corporate auditors is set at 60 million yen or less per year (the number of corporate auditors at the time of the resolution is 3), as per the resolution of the extraordinary general meeting of shareholders held on August 13, 2021.

Short-term performance-linked compensation

| |

Evaluation index |

Weight |

Goals for fiscal year

ended March 31, 2023 |

Achievements |

Level of achievement |

| 1 |

Core sales |

26.0% |

335,547 million yen |

329,737 million yen |

93% |

| 2 |

Operating profit |

30.0% |

32,684 million yen |

21,747 million yen |

67% |

| 3 |

Net profit |

19.0% |

15,586 million yen |

△12,893 million yen |

△83% |

| 4 |

Individual

performance goals |

25.0% |

Set for each person |

Set for each person |

Set for each person |

Internal Control System

The company will implement the following systems in accordance with our basic policy regarding the implement of internal control systems:

- Systems for ensuring that the execution of duties by directors complies with laws and regulations and the Articles of Incorporation

- A system for storing and managing information related to the execution of duties by directors

- Rules and other systems for managing the risk of loss

- Rules for efficient execution of duties by directors

- Systems for ensuring that the execution of duties by employees complies with laws and regulations and the Articles of Incorporation

- Systems for ensuring the appropriateness of operations within the corporate Group consisting of the company and its subsidiaries

- Matters related to employees who assist the duties of members of the Audit and Supervisory Board and the independence of those employees from directors

- Matters related to ensuring the effectiveness of instructions from members of the Audit and Supervisory Board to employees who assist those members in their duties

- Systems for directors and employees of the company as well as directors, corporate auditors and employees of subsidiaries to report to the members of the company’s Audit and Supervisory Board

- Systems to prevent unfavorable treatment if a person has made a report to members of the Audit and Supervisory Board

- Policies for processing expenses or debts arising from the execution of duties by members of the Audit and Supervisory Board

- Other systems to ensure that audits by members of the Audit and Supervisory Board are conducted effectively

Cross-Shareholdings

In principle, the company has a policy of not holding cross-shareholdings. However, if cross-shareholdings are held from the perspective of business strategy, the significance of the holdings must be confirmed by the Board of Directors at the time of acquisition. In addition, the Finance Department regularly conducts an inventory to determine the significance of cross-shareholdings, and if it is determined that holding the shares is not meaningful, the company will consider selling the stock. The results of the review are reported to the Board of Directors every year.

In regard to exercising voting rights, we do not set uniform standards, but rather respect the management policies and strategies of investee companies, and exercise voting rights after making a comprehensive judgment of whether doing so will contribute to improving the company’s corporate value over the medium to long term.

Employee Stock Purchase Program

PHC Group offers an employee stock purchase program for eligible employees in 14 countries, including Japan. Due to regulations in various countries, it can be challenging for individuals outside Japan to invest in companies listed on the Tokyo Stock Exchange, so this plan provides eligible employees opportunities to become shareholders at PHC Holdings Corporation. The purpose of the plan is to create a culture of ownership in the Company's business management, to create demand for the Company's shares, to improve liquidity in the stock market, and to enhance employee benefits by providing incentive payments for participation.

Cover (left) and inside pages (right) of the English booklet.

Cover (left) and inside pages (right) of the English booklet.

The booklet is available in various languages.

Policy Regarding Constructive Dialogue with Shareholders

In building a relationship of trust with our shareholders and other stakeholders, we believe that it is important to understand shareholder expectations and reflect them appropriately in management, and we will proactively respond to IR/SR activities.

Activity results

- At our company, the executive officer in charge of IR is in charge of the group’s IR activities. We have established an IR and PR Department, which proactively accepts telephone interviews and small meetings with investors. We also hold financial results briefings for analysts and institutional investors, where the President and CFO provide explanations. Dialogues (interviews) with shareholders are conducted by the President and Representative Director, the CFO also serves as the executive officer in charge of investor relations, with support from the IR and PR Department.

- As a support system for dialogues, the IR and PR Department collaborates with each business department and management department on a regular basis.

- We hold financial results briefings for shareholders and investors, and will also hold roadshows and other events for investors outside Japan as appropriate. In addition, we will continue to hold small meetings with investors.

- Feedback on IR/SR activities is regularly reported to the Board of Directors by the executive officer in charge of IR.

- When communicating with investors, whether at financial results briefings or small meetings, we manage insider information by focusing on matters related to the company’s sustainable growth and increasing corporate value over the medium to long term.

Audit and Supervisory Board

The Audit and Supervisory Board is composed of three members, including two external auditors. In addition to regular meetings, the Audit and Supervisory Board holds extraordinary meetings as necessary to discuss the state of governance and to hold audits of daily management activities related to the status of execution of duties by directors and the status of assets. Based on our management philosophy, we fully consider the positions of various stakeholders, including not only shareholders but also employees, customers, business partners, creditors, and local communities, and ensure appropriate collaboration with those stakeholders. At the same time, we strive to fulfill our fiduciary responsibilities to our shareholders, enhance the shared interests of the company and its shareholders, and strive for sustainable growth and the creation of medium- to long-term value.

If deemed necessary by members of the Audit and Supervisory Board, they will have the opportunity to interview directors or employees of the company and the Group. Members of the Audit and Supervisory Board hold regular meetings to collaborate with accounting auditors and the corporate auditors of important subsidiaries, and attend important meetings.

Status of Internal Audits

The company has established the Group Internal Audit Department as an organization under the direct control of the Representative Director, President and CEO. A total of 15 members, including the Group Internal Audit Manager, conduct internal audits (operational audits and internal control audits) of all divisions and subsidiaries of the company in a planned manner. Audit results are reported in writing (audit report) by the Group Internal Audit Department to the Representative Director, President and CEO, and related officers.

The Group Internal Audit Department reports on the status of internal audit activities to the Representative Director, President and CEO once per quarter, and reports on the status of each audit, exchanges information, and exchanges opinions with members of the Audit and Supervisory Board once per month. External officers receive reports on internal audits through the Board of Directors and the Audit and Supervisory Board, and provide their opinions to improve the practicality of audits. Other directors and auditors receive internal audit reports through the Board of Directors and the Audit and Supervisory Board, and improve the effectiveness of the audit by providing their opinions. Additionally, as necessary, we maintain appropriate collaborative relationships with auditors, directors, and external auditors of subsidiaries and affiliates, and strive to efficiently conduct internal audits.